Erika Karp (center in light blue shirt) and the the Team at Cornerstone Capital, an SEC-registered investment advisor and a WBENC-certified women-owned business.

impactmania spoke with Erika Karp, founder and CEO of Cornerstone Capital, Inc. Karp founded the investment advisory and wealth management firm after spending 25 years on Wall Street. She learned that she had been a sustainable investor all along, she just didn’t know the language.

Karp explains why corporate sustainability means corporate excellence, dispels some of the myths of impact investments, and would like to see an economy that is not about exploitation, but regeneration.

BY PAKSY PLACKIS-CHENG

Erika, I still hear many investors say, “When I invest I need to focus on maximizing financial returns and if I want to do good, I’ll just write a check and give a donation.” What is your response to that?

That sounds so sad to me. Think about how the economic multiplier effect can work with money — instead of spending it just on charity — spending it on impact investing. Especially if you know that you can do sustainable and impact investing without giving up competitive market returns. We have a lot of work to do to communicate the possibilities of investing with a purpose.

Most of the investors would say, “I hear so seldom of companies that have a strong focus on ESG activities and are also great investments.”

If we’re keeping our eyes and ears open, we can come across a lot of those companies. You have to remember that ESG is an analytical process. When we talk about ESG analysis, we’re talking about a systematic discipline of looking at the most critical environmental, social, and government factors.

We can both have sustainable companies and competitive investment returns.

Any given company is going to have its vision and its values and its mission and its tactics. There are also critical ESG factors we need to know that relate to their business; What are they doing to optimize their performance? Whether it’s a Unilever, Novo Nordisk, Intel, or Patagonia, there are many companies that are doing wonderful things around issues with climate change, women’s economic empowerment, water efficiency, or animal welfare. There are many companies that are doing important things in the areas that affect their businesses.

So analyzing corporate sustainability is critically important. We only work with asset managers that do that kind of analysis deeply and properly.

Give me an example of how you would measure these non-financial returns. There are many different measurements.

I don’t refer to sustainable investing factors as non-financial. They’re pre-financial. We often don’t know how to measure them, but if they are important to the investment outcomes, then a professional investor will consider them.

When you think about measurement, if we look at a beverage company, I would want to know what are their programs for water efficiency. With a chemical company, we want to understand the safety of their supply chain. If we’re talking about a mining company we want to understand their community relationships.

There are different ways to measure each of those. You could look at some of the ratings systems, you could do the fundamental research yourself, or you could look at the corporate disclosures on these issues.

A lot of people are still are puzzled by this, right? You have to dig through the company’s financials; you have to find their stories about how they go about driving change or being good citizens in the communities. How do you even start to compare?

If you take two companies in the beverage industry, or two companies in the energy sector, or two companies in technology, first you look at the basic things. You look at growth and you look at valuations.

Then you want to figure out the sustainability factors. Figure out what matters most to you. If you’re a climate change proponent looking at chemical companies, you want to know what their carbon emissions are. Then you can compare the two companies. I would say for the individual investor that it is really hard to do — this kind of analysis. That’s why there are many portfolio managers and asset managers. We do our best to pick expert asset managers.

It’s very important to know what matters in different industries. For instance, if a financial services firm is only providing data around their carbon emissions, you’re thinking, What the hell, right? They’re talking about stuff that doesn’t matter all that much. That’s actually a negative signal, in my view.

You touched on something, where you said that people have a misguided idea to think that companies will have to give up profit or margins because they are adhering to sustainable factors in their company. Give me an example of where you saw that that’s clearly not the case.

There’s always going to be tradeoffs: revenues, margins, and costs. Capital is not infinite. I mean look at GM, look at Volkswagen, look at Wells Fargo — you think about those companies — complete collapses in governance.

And by the way, it’s interesting to see what companies do after crisis. Sometimes that can define a company. Nike is a good example; the crisis of labor ultimately led to Nike to becoming a better much company. They chose to figure out how to be a highly sustainable company. I wonder if Volkswagen will do the same? We don’t know yet.

When it comes to corporate sustainability, it’s usually a long-term view versus short term.

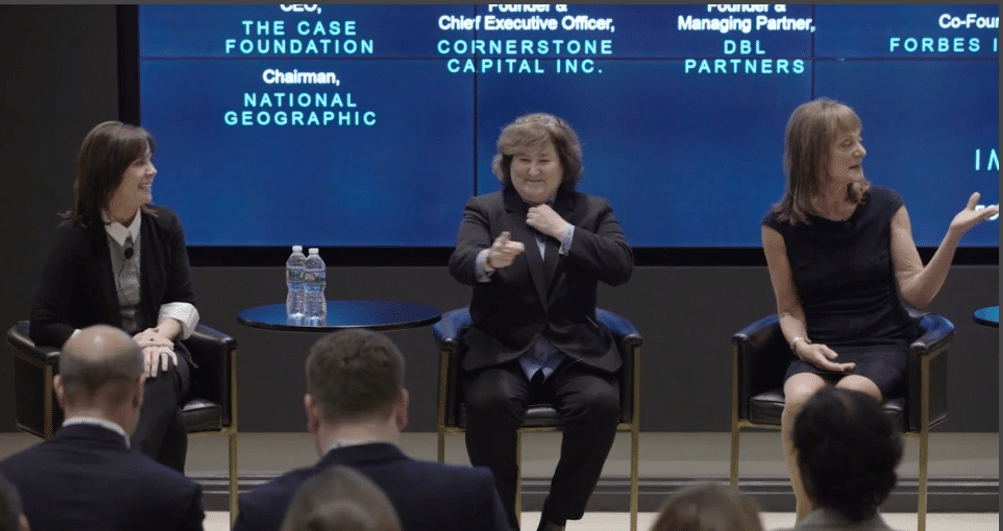

At the Forbes Impact Investing Launch (2017). Erika Karp (center) with Nancy Pfund (right), founder of DBL Partners, and Jean Case (left), CEO of the Case Foundation. Erika Karp has spoken at events at the OECD, UN, The Forum for Sustainable and Responsible Investing, and the White House.

We are in the midst of the largest wealth transfer in history. Do you see the next-generation investing more mindfully and what are some of the tools that they use?

Yes, they are clearly more conscious about the societal imperatives. They’re dramatically more exposed to social media, which means they are dramatically more demanding for transparency. They are more critical and cynical about existing institutions of the world. The fact that they have dramatically more access to data is new. All of these things have driven that trend, that movement, towards more conscious investing.

In terms of tools for gathering information and insight: social media and big data are tools that they have, which weren’t tools of the capital markets a generation ago.

Also, we’re starting to build frameworks or standards for disclosure by companies of the most important ESG factors. The data that’s being disclosed in the sustainability reports that are put out by many companies are tools.

There are no easy answers, but broad brush, what is needed to transform or at least evolve the current financial system?

We need a lot more transparency. We need more authenticity. We need better leadership, frankly. We need more accountability. We need better data. We need more standards.

I am laughing, Erika, because how and when do we start?

Now, we start now! We really do need to put to bed the myth of underperformance. We also need to put to bed the misguided notion that ESG analysis is some kind of breach of fiduciary duty. It is absolutely not. And we need more commonality in language, it’s confusing to people right now.

What has been a surprising learning building Cornerstone Capital?

What’s been a bit surprising is the business development cycle. It does take a long time for people to take decisions. So when you have such a fierce urgency…I always want it to go faster.

We always ask our interviewees who’s left an imprint on their professional DNA.

I spent 25 years on Wall Street. I’ve been privileged to see the best of the best. And I have also seen the worst of the worst. The key is to take lessons from both.

Then, ultimately, an entrepreneur just simply has to pursue an opportunity that you think is right. That’s when you take the leap. It’s a combination of impatience and frustration and confidence that you’ve got it right. Anyone will tell you that being an entrepreneur is like jumping out of a plane and building a parachute on the way down. Wall Street is not known for taking leaps of faith on business models. But again, when you think you have something special, you go for it.

What spurred this?

Learning. About eight years ago I was handed the management responsibility for a team that was doing SRI [Socially Responsible Investment]. I learned very quickly that I’ve always been a sustainable investor. I just didn’t know the language.

I learned the language of ESG analysis and tried to remove the ideology and political nature of these dialogues. I tried to remove the divisiveness. I looked towards pragmatism, enhanced analytics, and inclusiveness. I was able to translate the language of sustainability to the language of Wall Street, and vice versa. That was a big learning for me, that if you have institutional analytical credibility, it helps drive a movement. When I first discovered ESG analysis, I started to feel like a kid in the candy store. I’m thinking, There are so many avenues of inquiry to find predictive insight into the investment process. When you can help people re-think their assumptions, and re-think what they believe that they know through analysis, that’s really cool.

Any parting advice for companies on how to be more sustainable in their way of business.

Yes, a commitment has to be both top down and bottom up. It has to be board level engagement and then there has to be an understanding of materiality, what matters in ESG. Then there has to be consistency, accountability, incentivization, and engagement. Then bottom-up: understanding sustainability as it relates to the business at hand is absolutely critical if a company really wants to deeply integrate their values and mission with the outside environment. Ultimately, we want to go from an economy that is not about exploitation, but rather an economy that’s about regeneration.