Building Businesses for a Better World

BY PAKSY PLACKIS-CHENG

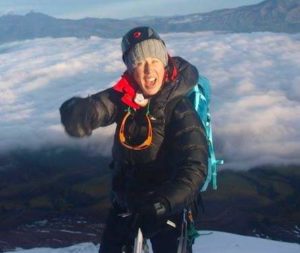

Alissa Sears is Christie & Co’s Vice President of Growth & Strategy. At most communications firms, that is a desk job. Sears, however, takes her clients and investors to the world’s most active volcano, Cotopaxi, in Ecuador and skiing in the backcountry of Colorado. She shared why she cofounded adVenturesAcademy, an intensive program that brings together value-aligned investors and entrepreneurs to build businesses for a better world.

You’ve taken entrepreneurs and investors for a week in Ecuador. Now a group of 25 people are off to Colorado. What are you trying to accomplish with these programs?

We are looking to help build resilience in leaders dedicated to building a better world. The goal is to help transform the relationship between investors and entrepreneurs to help ensure alignment and strength as mission-driven companies grow. In building these pioneering, game-changing companies, it is essential for both the entrepreneur and investor to truly know who the other person is to ensure they’re building companies based in a shared vision rather than in an adversarial or fragmented way. The pitch and be pitched model so often leads to misaligned interests and a very guarded interaction which can lead to long, drawn out due diligence processes which is costly for both the investor and the entrepreneur.

Did it come from a need that you saw?

Yes. Over the last 25 years, we have worked with so many growing companies that would hit the same bumps and bruises along the way — or not fully realize their potential… because they thought that they had to bring on a certain investor or certain distributors [instead of] following their vision. You can achieve growth goals and maintain your values as you scale by finding the right partners who understand your values and work together to develop growth strategies and have the expertise and experience and resources to align with that.

In a conference room or in a boardroom, you’re not getting to the heart of that. It’s very pitch-and-be-pitched. You’re missing the passion of the people that are actually building these companies, often shrouded by spreadsheets.

Making that market opportunity become reality can happen a lot faster and a lot more efficiently when you actually get to know both entrepreneurs and investors as people.

How do you find out what they’re made of?

It’s fun. It’s a matter of finding the people that are truly game changers, the ones that are bringing new ideas and products to market — those poised to scale and ready for that growth — then finding the investors that really want to work alongside [them]. From that point, we find the team to build the program to bring these amazing leaders together through adventure. We have an amazing review committee and advisory team that goes through an amazing process getting them ready.

In Colorado, we’re taking them on a backcountry hut trip. We have a number of our advisors and partners who are high-altitude guides and have developed incredible programs for over twenty years.

Colorado Backcountry Investment Camp

In Ecuador, we built an entire orienteering course. Everybody had to pair up; we had teams that had to work together. They had to work together to develop strategies, read the topo maps to assess the most effective route to find all these checkpoints. We conducted growth workshops and teambuilding activities. Then we climbed Cotopaxi. It’s so raw and so real. You’re connecting with each other and seeing things in people [you] wouldn’t have seen in a boardroom.

Cotopaxi in Ecuador – the world’s tallest active volcano

That is why the outdoors?

I think self-awareness is really critical and a lot of what gets shared in the outdoors. The adVenturesAcademy is all about the peace you find in yourself outdoors – the space to be raw, real, and honest, truly yourself, when you can have that time and space to reflect and grow and realize that potential. And then connect with others who see you for who you are, strengths, weaknesses, it’s all out in the open. Then when it comes to building a business together, it’s already based on this shared experience of working together. Entrepreneurs feel more able to approach investors when they know them as people first rather than feeling as though they can’t admit vulnerability when a problem arises after a grueling due diligence process… when they haven’t gotten to actually know each other as people first. This transforms that relationship to being deeper and more meaningful – more able to withstand the challenges faced throughout the growth process of a company.

When we were on Cotopaxi, there’s an investor to their rope team partner: “I’m going back with you. And if you’re turning around, I’m turning around.” They’ve never known each other before, and this is a leading VC, and he’s like, “I’m in it with you.”

What do great investors have in common?

They ask questions. The deep curiosity of really understanding things – how they’re built, why they’re built, who is building them, what is the potential for scale, challenges, opportunities. There’s a thoroughness and perspective that is very rare – an ability to see the unseen – and understand what is needed to make it reality and realize that growth potential most people may never see. They really want to understand, who is that entrepreneur? Who is the team around them? What is the need that they’re solving? Great investors want to work together and get to the heart of adding value above and beyond the resources.

How do you respond to investors who say, “Companies who drive profit and purpose don’t scale well.”

There are many companies that have scaled substantially and have a strong core purpose: Patagonia, Clif Bar, and Etsy.

Are these outliers?

I don’t think so. Day in and day out, we see companies tackling amazing issues through business and this now is becoming the norm, not the outlier.

This is a breed of entrepreneurs who reject the old adage, “Nothing personal. It’s just business” and put their hearts and souls into making business deeply personal… and highly successful. They are redefining Return Of Investment (ROI) by building businesses that have a positive impact on everyone touched by them — employees, families, suppliers, consumers, communities, the environment, and investors.

The boxes around “doing good” and “doing well” are being shattered by this rebellious breed of entrepreneurs who no longer feel that there is a dichotomy between “good” and “well.” They are proving that harmonizing those as the core of their business strategy can be the defining characteristic of great brands – and good business. No longer is impact relegated to the CSR department or an annual report. It is the driving force of success at the heart of these companies.

According to the 2015 Nielsen Global Corporate Sustainability Report, sales of consumer goods from brands with a demonstrated commitment to sustainability have grown more than 4% globally, while those without grew less than 1%. Furthermore, Impact Investing is growing rapidly as an investment strategy that seeks to generate positive financial, environmental and social returns. It has gone from the margins to mainstream. J.P. Morgan estimated that global impact investments exceeded $50 billion in 2010 and predicted that invested capital in the impact investing market could reach $400 billion to $1 trillion by 2020.

What is challenging between investors and entrepreneurs?

To be in a place where people feel safe enough to have tough conversations. Some entrepreneurs have said [when discussing the traditional investor / entrepreneur relationship], “It’s so much about being the peacock… You’re sort of posturing and trying to be perfect, impress the investors and help them see the vision. You don’t ever feel safe enough to be able to tell them where the challenges are.”

Our goal is to create an environment where people feel they can have those real conversations. Then you’re not finding out later, like, “Wow, there were a couple of things missing here. We had no idea.” Maybe there is a challenge that could have been figured out before it became a huge liability — if everyone just talked about it.

Do you track and support these companies after a summit?

Yeah, we have a company that just actually received their investment from Ecuador. We stay in touch with them, and as we continue to grow and build out the model, the community continues to grow. The shark-tank model doesn’t work for most people because it’s very adversarial.

How are you hoping to impact someone?

If I can help catalyze the realization of potential and helping people see that they can do whatever it is that fires them up… The more we learn and figure out our talent, abilities, and passion — and we can align that with our purpose — it’s remarkable what can be done. I learned early on we can’t do any of it alone.

What is the word that describes your journey so far.

It’s been awesome. I had seen a quote in National Geographic: It said adventure is a physical manifestation of the human spirit. I’ve carried that with me for so long. That has been the heart of adVenturesAcademy. It’s been truly awesome.

adVentures Academy

Join Alissa Sears and fellow entrepreneurs and investors for the next adVenturesAcademy.